40 Page views

40 Page views

Economic Times Mumbai Maharashtra Real Estate Regulatory Authority (MahaRERA) Bombay Dyeing Mahindra Life Space Godrej Properties Marathon Nextgen Oberoi Realty Affordable Housing Real Estate Regulatory Authority (RERA)

Mumbai-based realty firms have scorched the charts on the Street in recent times on expectations that there would be a major shift in favour of organised real estate players, especially after the stringent implementation of the Maharashtra Real Estate Regulatory Authority (MahaRERA).Analysts also attributed the rally to the opening up of funding avenues for commercial realty projects.

Stocks such as Bombay DyeingBSE 4.85 %, Mahindra Life space, Godrej PropertiesBSE 0.65 %, Marathon NextgenBSE 2.33 %, and Oberoi RealtyBSE -0.28 % have rallied between 20 per cent and 148 per cent in the past one month, against 7 per cent gain in the BSE Realty index.

Several small realty developers are, in fact, merging their projects with large established developers to comply with MahaRERA which will give good business to the organised players, claimed market participants.

"The recent introduction of the RERA has pumped in a new lease of life into the sector. It is expected to weed out unorganised players and whip up buyer confidence, restoring the much-needed buoyancy," said Chintan Modi, analyst, Motilal Oswal Financial ServicesBSE -4.60 %. "Maharashtra will see a very early consolidation compared with other markets as MahaRERA is functioning very efficiently here." In the medium term, less-capitalised, or non-serious players, may find complying with the RERA provisions difficult, leading to partial or full exit from their projects. Serious and wellcapitalised players should benefit from this with increased demand and higher realisations, said experts.

"The provisions of capital adequacy , full disclosures and strict penalties should lead to greater transparency and increased customer confidence.This, coupled with favourable longterm fundamentals, should benefit the sector," said Harshal Pandya, analyst, EdelweissBSE -2.99 %.

Analysts are bullish on most Mumbaibased realtors, and most broking houses that are tracking Mahindra LifespaceBSE 2.74 % and Godrej Properties have given a buy rating to the stock. "We like Mahindra Lifespaces given its strong parentage, management's focus on improving return ratios through strategic partnerships, affordable housing foray and comfortable balance sheet at 0.2 times debt to equity ," said Deepak Purswani, analyst at ICICI Securities.

Mohit Agarwal, analyst, IIFL, said that Godrej Properties is in a sweet spot to benefit the most from the ongoing reforms in the real estate sector such as RERA and affordable housing.

NCRTC Honoured with IGBC Platinum Rating for Anand Vihar Namo Bharat Station

Major Central Business Districts (CBDs) in Tier-2 Indian Cities to Watch for Commercial Investments in 2025

Yogi Government’s Bold Move: Satellite ‘Invest UP’ Offices in 5 Metro Cities to Boost National & Global Investments in Uttar Pradesh

Yeida Clears Rs 17 Billion Road To Link Noida Airport, Greater Noida

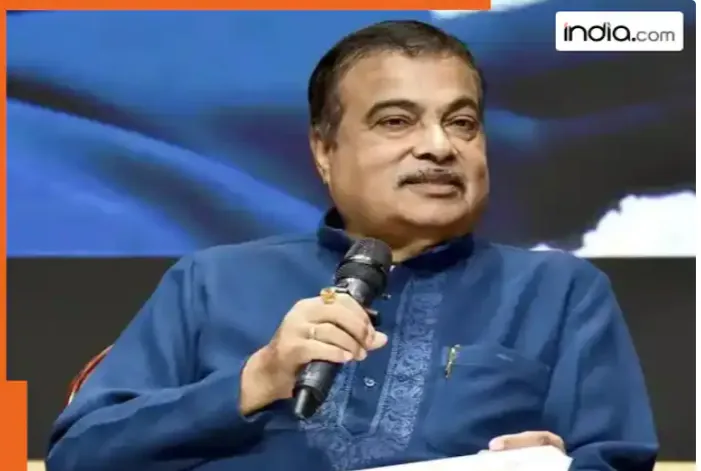

Delhi to Gurugram in 20 minutes? Masterstroke by Nitin Gadkari as construction of expressway connecting THESE places begins, it will cost Rs…